Top FAQ

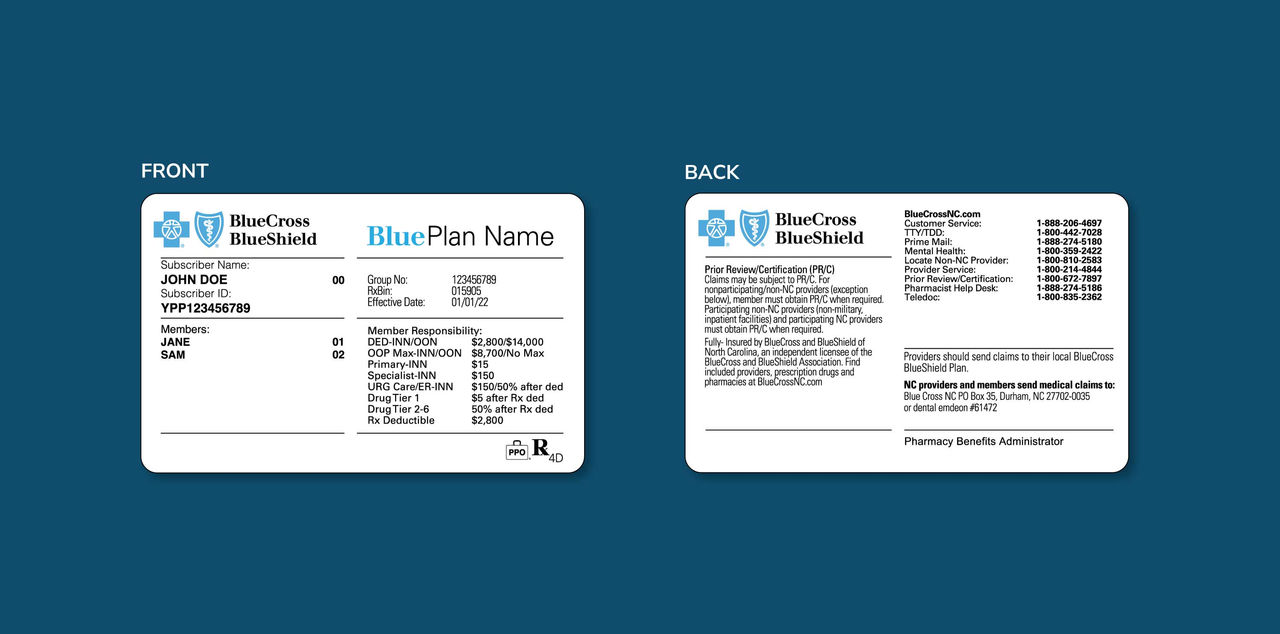

An insurance card from Blue Cross NC looks like this:

It's your identification that says, "I am a Blue Cross NC member." The back of your card has several important phone numbers to use when you need help. Keep this card with you. You'll need to show it every time you visit an emergency room, urgent care center or health care provider.

Are you already a member?

On Blue Connect, your member portal, you can see, download and print your member ID card, and order new ones. Replacement cards are typically mailed to your home address in 3-5 business days. Simply log in to Blue Connect or call Customer Service at 877-258-3334.

Member ID cards are not available for expired or cancelled policies.

Access the most up-to-date provider information with our Find Care search tool. With it, you can locate providers by name, specialty, county or zip code. The Provider Search information is updated weekly.

You can also contact Customer Service at 877-258-3334 for help locating a provider or to get a paper copy of the directory. Also, many employers have a directory in their Human Resources department.

Yes. You can pay your premium online using a credit card, debit card or electronic transfers from a bank account (you'll need to log in to Blue Connect or register for Blue Connect first). Go to Blue Connect Billing & Payments.

You can: Make a one-time payment or set up automatic recurring payments. When you establish recurring payments you will no longer receive invoices by postal mail. Emailed bill notifications are available to let you know when you have a new bill online.

A deductible is the dollar amount you must pay for covered services in a benefit period before benefits are payable by Blue Cross NC. You must satisfy your deductible amount once each benefit period. The deductible does not apply to most services where a copayment applies, with the exception of emergency room visits or in-patient stays. In those cases, the copayment is couple with the applicable deductible.

A copayment is the fixed dollar amount you must pay for some covered services. The provider usually collects this amount at the time the service is provided. Copayments are not credited toward the individual or family benefit period deductible.

Travel coverage varies according to the health plan you have. Log in to Blue Connect to check your Benefit Booklet or log in to your plan's member page, then go to the Frequently Asked Questions to learn more.

You can change your name or address in several ways:

- Complete Sections A and B of an Enrollment and Change Application available through Customer Service or your employer

- Contact Customer Service at 877-258-3334

- Log on to Blue Connect. With Blue Connect you can request up to two new member ID cards or update your policy's contact information when your address, phone number or email address changes.

You have the right to request a formal appeal of the claim payment or denial. A detailed description of this process may be found in your Member Guide. Customer Service can also assist you in starting the appeal process.

Blue Cross NC will work with you to resolve the issue. For each step in the appeals process, there are specified time frames for filing a grievance and for Blue Cross NC to notify you or your provider of the decision.

Account management

First, you'll need to log in to Blue Connect and have your Member ID card ready and follow these steps:

- Select Account and then select Add a Policy.

- On the Add a Policy page, enter your information and select Next.

- Enter your Member ID number and select Next. (It's the two-digit number to the right of your name).

- Confirm your security question and email address prior to selecting Submit. You should see the policy added to the list on the Account Overview page.

If you've already registered another plan on another user account, you'll see "Your policy has already been registered." You'll be asked to sign in to that account. Once you enter your User ID and password, you'll have the option to combine the accounts.

If you purchased your own plan through HealthCare.gov, you will need to cancel your plan on HealthCare.gov.

If you purchased your own plan without going through HealthCare.gov, you can request to cancel your plan through Blue Connect.

Steps to make request:

- Log in and go to your Blue Connect Secure Inbox

- Select the Compose button

- Select Cancel My Plan as your message topic

- Fill out the request form and submit

Otherwise, please call the number on the back of your ID card for assistance.

You can change your name or address in several ways:

- Complete Sections A and B of an Enrollment and Change Application available through Customer Service or your employer

- Contact Customer Service at 877-258-3334

- Log on to Blue Connect. With Blue Connect you can request up to two new member ID cards or update your policy's contact information when your address, phone number or email address changes.

Follow these steps:

- Log in to Blue Connect

- Choose Account

- Choose Manage Billing & Payments

- Choose Edit My Billing Profile on the right

If you're cancelling recurring payments and no further action is taken, the change to your account profile will take affect for the next billing period.

You can make changes as long as it's not within 10 days of your invoice date. During this period you will be unable to cancel recurring payments.

You can call Web Support at 888-705-7050.

Approvals and referrals

Prior approval and referrals depend on your plan. To learn more, log in to Blue Connect and read member's frequently asked questions (FAQs).

If you do not receive prior approval or certification for services (except emergency care or maternity), your claim may be denied, paid at a lower benefit or a penalty may be applied.

Prior approval and referrals depend on your plan. To learn more, log in to your member portal on Blue Connect where you can find the rules for Prior Approvals and Authorizations in your Benefit Booklet.

You do not need to get a referral from your primary care provider to receive covered services from a participating specialist. However, some participating specialists may require a new patient introduction from your treating doctor.

Billing and payments (for individual and family health or dental plans)

Yes. You can call 800-333-7009 to pay by phone.

No. Blue Cross NC is currently unable to accept partial premium payments. Online, you may pay just your past amount due with a one-time payment, but you will still owe the current amount due. If you mail in a partial payment, there is no guarantee that your claims will be paid or your policy will remain active if the full payment amount is not received by the payment due date.

You can pay the current month's payment online or by Pay by Phone 800-333-7009.

To pay online, you'll need to pay the exact amount for that month as long as it's not past your grace period. If you're only paying the current month's amount, make sure the payment matches the amount in the Balance Forward field in the Current Account Status section.

If it's past your grace period, you must pay the total amount due or your policy will be canceled.

Yes. You can pay your premium online using a credit card, debit card or electronic transfers from a bank account (you'll need to log in to Blue Connect or register for Blue Connect first). Go to Blue Connect Billing & Payments.

You can: Make a one-time payment or set up automatic recurring payments. When you establish recurring payments you will no longer receive invoices by postal mail. Emailed bill notifications are available to let you know when you have a new bill online.

Yes.

Bank Draft: You can set up automatic recurring payments with a bank draft by entering your bank account information in the Billing & Payments area of Blue Connect, our secure member site.

Credit or Debit Card: You can set up automatic recurring payments by credit or debit card by entering your credit or debit card information in the Billing & Payments area of Blue Connect, our secure member site. We accept credit or debit cards with MasterCard, Visa, American Express or Discover logos. For bank draft, credit card or debit card, simply log in to Blue Connect, go to Billing & Payments and set up AutoPay.

Yes. All members have a grace period and it starts from the due date on the invoice. The standard grace period is 25 days. You should pay no later than the 1st of the month following the due date.

If you purchased your plan on the Health Insurance Marketplace and aren't eligible for a tax credit, you have a 25 day grace period.

If you purchased your plan on the Health Insurance Marketplace and are eligible for a tax credit, you have a 90 day grace period.

A grace period is a specific amount of time allowed after a due date to make your payment so that services can continue (in this case, your policy is not canceled immediately after a missed payment).

All Blue Cross NC individual plan members have a grace period, which starts from the due date on your invoice but can vary depending on your plan. You should make a payment by 6:00 p.m. Eastern Standard or Daylight Savings Time on the 1st of the month, but if you can't, you have time before your plan is canceled. The standard grace period is 25 days. Health Insurance Marketplace members (you bought your plan using the ACA exchange) without a tax credit have a 25-day grace period. Health Insurance Marketplace members with a tax credit have a 3-month grace period.

Risks of late payments: It is still possible during this time for your claims to be denied. If you don't get caught up on payments, your policy will be canceled.

You may change your billing address online. When you log in to Blue Connect, select the Billing & Payments icon on your Blue Connect home page and then select Edit Billing Preferences. Any change you make will be processed within 48 hours.

You can call Web Support at 888-705-7050, send us a secure message through Blue Connect, or email us.

If you make a one-time payment online, you can still receive a paper bill. You also have the option of going “paperless” and receiving email notification when your invoice is available online. If you sign up for automatic recurring (monthly) payments, you are automatically enrolled in email bill notifications and you will no longer receive bills by postal mail.

Starting October 2017, AutoPay billing notifications are sent 5 days prior to the due date of the 1st of the month.

See the different bank draft payment options below for the answer:

For a one-time premium payment: Your payment will be withdrawn from your bank account usually within 48 hours of submitting the payment.

For automatic recurring bank draft payments: If you don't have a balance due when you sign up for recurring payments, your payment will be withdrawn from your bank account on the 3rd day of each month (or the next business day if the 3rd falls on a weekend or holiday).

When signing up for recurring bank draft payments: If you have a balance due, the amount of your balance will be withdrawn from your bank account usually within 48 hours of payment. All payments after that will be drafted on the 3rd day of each month (or the next business day if the 3rd falls on a weekend or holiday).

See the different credit or debit card payment options below for the answer:

For a one-time premium payment: Your credit or debit card payment will be charged when you make that payment.

For automatic recurring (monthly) credit or debit card payments: If you don't have a balance due when you sign up for recurring payments, your credit or debit card will be automatically charged on the 1st day of each month (or the next business day if the 1st falls on a weekend or holiday).

When signing up for recurring credit or debit card payment: If you have a balance due, your credit or debit card will be charged for that amount when you make that payment. All payments after that will be automatically charged on or around the 1st day of each month.

No. Blue Cross NC provides this service at no cost to registered log in to Blue Connect members enrolled in individual and family plans. Although Blue Cross NC does not charge for this service, some banks may charge a fee for automatic bank drafts. Check with your bank for more information.

The Past Due date doesn't include your grace period. You have until your grace period expires to make a payment.

Blue Cross NC offers several convenient methods for paying your premium. In all cases, premium payments must be posted by 6:00 p.m. Eastern Standard or Daylight Savings Time:

Online: The subscriber can establish electronic transfers from a bank account to pay your premium online. Go to your Account Summary in Billing & Payments. Make a one-time payment or set up automatic recurring payments. When you set up AutoPay, you will no longer receive invoices via paper mail. Emailed invoices are available.

Check: Include a check with your monthly invoice and mail it to Blue Cross NC at the address on the invoice.

Credit or Debit Card: Credit or debit card payments may be made online. Go to your Account Summary in Billing & Payments to make a one-time payment.

Phone: Call 800-333-7009 to make a one-time payment with a credit card, debit card or bank draft.

Billing and payments (for Medicare members)

Blue Medicare Advantage, Blue Medicare Supplement and Blue Medicare Rx plans

You can only make partial payments by mail. You cannot make partial payments online or by phone. Please keep in mind that if you mail in a partial payment, there is no guarantee that your claims will be paid or your policy will remain active if the full amount is not received by the payment due date. This applies to all Blue Medicare plans. If you would prefer to mail your payment, please use the return envelope provided to avoid processing delays.

Blue Medicare Advantage, Blue Medicare Supplement and Blue Medicare Rx plans

No. Business checks are not accepted for individual premium payments. If you would prefer to mail your payment, please use the return envelope provided to avoid processing delays.

Blue Medicare Advantage, Blue Medicare Supplement and Blue Medicare Rx plans

Yes. However, you can only submit a money order payment by mail. Be sure to include your subscriber ID number on the money order to ensure your payment posts to your account on time. If you would prefer to mail your payment, please use the return envelope provided to avoid processing delays.

Blue Medicare Advantage and Blue Medicare Rx

You can make a one-time payment online and by phone.

To pay online, log into your Blue Connect℠ account. Go to “Billing & Payments,” and then select “Pay Now" under the plan you would like to pay. Follow the prompts to finish paying. Available payment methods online include debit cards, credit cards or bank draft.

To make a one-time payment by phone, call 844-395-4535. Available payment methods by phone include debit cards, credit cards or bank draft.

Blue Medicare Supplement

You can make a one-time payment online and by phone.

To pay online, log into your Blue Connect account. Go to “Billing & Payments,” and then select “Pay Now" under the plan you would like to pay. Follow the prompts to finish paying. Available payment methods online include debit cards, credit cards or bank draft.

To make a one-time payment by phone, call 844-395-4535. Bank draft is currently the only payment method available by phone.

Blue Medicare Advantage, Blue Medicare Supplement and Blue Medicare Rx plans

Yes, we accept payments made through your bank's online bill pay service or other third-party bill pay vendors. When you sign up for the service, be sure to include your Blue Cross NC subscriber ID to ensure your payment posts to your account on time.

Blue Medicare Advantage, Blue Medicare Rx

Members of these plans are not able to reinstate their policy online. However, you can log in to your Blue Connect℠ account to send us a secure message or chat and we’ll be happy to help you. If you prefer, you can also call us at the number listed on the back of your member ID card.

Medicare Supplement plans

To reinstate your policy, you’ll need to first pay the outstanding balance. To do that, log in to your Blue Connect account. Go to “Billing & Payments.” Then, select “Pay Now" under the plan you would like to pay and follow the prompts.

Once your account is paid, send us a secure message or chat and we’ll be happy to help you. If you prefer, you can also call us at the number listed on the back of your member ID card.

Blue Medicare Advantage, Blue Medicare Supplement and Blue Medicare Rx plans

To set-up automatic recurring payments online, log into your Blue Connect℠ account. Go to “Billing & Payments,” and then select “Pay Now" under the plan you would like to set-up on recurring payments. Follow the prompts to finish paying. Recurring payments are only available using a bank draft.

Blue Medicare Advantage, Blue Medicare Rx

To reinstate your policy, log in to your Blue Connect℠ account. You can log in to your Blue Connect account to send us a secure message or chat and we’ll be happy to help you. If you prefer, you can also call us at the number listed on the back of your member ID card.

Medicare Supplement plans

To reinstate your policy, you’ll need to first pay the outstanding balance. To do that, log in to your Blue Connect account. Go to “Account / Profile” and select “Manage Billing & Payment.” Then, select “Pay Now" under the plan you would like to pay and follow the prompts.

Once your account is paid, send us a secure message or chat and we’ll be happy to help you. If you prefer, you can also call us at the number listed on the back of your member ID card.

Blue Medicare Advantage, Blue Medicare Supplement and Blue Medicare Rx plans

You can log in to your Blue Connect℠ account to send us a secure message or chat. We’ll be happy to help you. If you prefer, you can also call us at the number listed on the back of your member ID card.

Blue Medicare Advantage, Blue Medicare Supplement and Blue Medicare Rx plans

We create and send invoices between the 5th and 10th of each month. It takes about 7–10 business days before you will receive your invoice by mail. It’s likely that the late notice was mailed before we received your payment. You can always log in to your Blue Connect℠ account to check the status of your payment.

If you would prefer to mail your payment, please use the return envelope provided to avoid processing delays.

Coverage

You have the right to request a formal appeal of the claim payment or denial. A detailed description of this process may be found in your Member Guide. Customer Service can also assist you in starting the appeal process.

Blue Cross NC will work with you to resolve the issue. For each step in the appeals process, there are specified time frames for filing a grievance and for Blue Cross NC to notify you or your provider of the decision.

Access the most up-to-date provider information with our Find Care search tool. With it, you can locate providers by name, specialty, county or zip code. The Provider Search information is updated weekly.

You can also contact Customer Service at 877-258-3334 for help locating a provider or to get a paper copy of the directory. Also, many employers have a directory in their Human Resources department.

Blue Cross NC will mail a comprehensive Benefit Booklet to your home after you enroll. It has detailed information about your specific benefits and covered services.

You'll find a lot of information on benefits, claims and other member services on our website and in your Blue Connect member portal. Log in to Blue Connect to see your:

- Member ID cards

- Plan benefits

- Claim status

- Bill pay options

- Deductible balances, copayment amounts, coinsurance percentages and other out-of-pocket costs

- Contact information in the Contact Preferences Center

Need help?

You can send a secure email anytime to Customer Service through Blue Connect or call 877-258-3334, Monday to Friday, 8 a.m. to 7 p.m. ET.

The coverage rules are different for every type of plan. To find the information you need, visit the Help section and FAQs on your plan member page. Or log in to Blue Connect to see the coverage details in your Benefit Booklet.

If your employment ends, you may have certain options such as continuing health insurance under this health benefit plan or purchasing a nongroup conversion policy. Contact your employer or group administrator to learn about the options available.

Continuation of Coverage Under COBRA

Under a federal law known as COBRA, covered employees and their dependent(s) of employers with 20 or more employees can elect to continue coverage for up to 18 months by paying applicable fees to their employer in the following circumstances: your employment is terminated (unless the termination is the result of gross misconduct) or your hours worked are reduced, causing you to be ineligible for coverage.

For more information about your coverage options under COBRA, contact your group administrator or refer to your Member Guide.

Continuation of Coverage Under State Law

Under state law, employees and their dependent(s) of any size group have the option to continue group coverage for 18 months from the date that they cease to be eligible for coverage under the health benefit plan. Employees are not eligible for continuation under state law if:

- The employee is currently eligible for COBRA coverage

- The employee's insurance is terminated because they failed to pay the appropriate contribution

- The employee or their dependent(s) requesting continuation are eligible for another group health plan

- The employee was covered less than three consecutive months prior to termination

You must notify the group of your intention to continue coverage and pay the applicable fees before your period of eligibility has ended. The state law benefits run concurrently and not in addition to any applicable federal continuation rights.

For more information about your coverage options under state law, contact your group administrator or refer to your Member Guide.

Purchasing a Non-Group Conversion Policy

If you would like more information about purchasing a non-group policy, please contact Customer Service at 877-258-3334 or visit the Plans for Individuals section of our site.

You may be eligible to continue your coverage under your group health plan for a certain period of time after you retire. Your group administrator will advise you about continuation of coverage under your health benefit plan.

Dental

You may experience a change in your monthly premiums at the time of your annual renewal (January 1 of each year), or when you add or remove dependents.

Orthodontia service is an optional benefit which your employer can choose to include in coverage. Please contact your Group Administrator or refer to your Benefit Booklet to determine if Orthodontia is part of your plan.

Dependents can be added to your dental plan at any time; however, standard waiting periods, if applicable, will apply.

You can only change your dental plan within 60 days of a qualifying life event, like marriage, divorce, etc. or during renewal each year. Standard waiting periods, if applicable, will apply.

Most dentists will file a claim on your behalf, then bill you for any charges not covered under your Blue Cross NC plan. If your dentist will not file the claim for you, pay the dentist at your visit and submit your claim to Blue Cross NC for reimbursement.

Many participating providers will file the claim on your behalf. If your dentist office doesn't file claims, you should pay the dentist in full and submit your claim to Blue Cross NC for reimbursement. Download a dental claim form and mail it to us within 180 days from the date of your service.

Mail a completed claim form to:

Blue Cross and Blue Shield of North Carolina

Dental Claims Unit

P.O. Box 2100

Winston-Salem, NC 27102-2100

You can look for your dentist by using our Find Care search tool.

Yes, you will have an ID card for your medical plan and a different ID card for your Dental Blue Select plan.

Yes, you may apply for dental coverage that covers your child only.

No. There is no waiting period for diagnostic and preventive services such as routine checkups and cleanings. Waiting periods may apply to basic and major services. Please refer to your Benefit Booklet for details on your specific dental plan.

No, there is no annual deductible. Dental Blue Select features a $100 lifetime deductible that applies to all services (diagnostic and preventive, basic and major services), except orthodontia services. Orthodontia services do not have a deductible.

Your initial payment can be made by credit card or bank draft. After that, monthly premium payments can be set up for credit card, bank draft or direct bill.

Download the Dental Blue Select claim form, complete it and mail to:

Blue Cross NC

Dental Blue Select Claims Unit

PO Box 2400

Winston-Salem, NC 27102

Please call Dental Blue Select Claim Customer Service at 888-471-2738.

All applicants (both under and over 65) and their dependents (spouses, domestic partners and/or children under the age of 26) are eligible. Applicants must be North Carolina residents who have not had a Dental Blue for Individuals policy in the last 12 months.

Yes, Blue Cross NC may waive or reduce any applicable dental waiting period by the number of months of prior dental coverage. Proof of prior dental coverage with less than 63 days lapse in coverage is required.

You must have had full coverage for preventive, basic and major services. Preventive only, Discount Only or Dental Savings Plans do not count as full coverage for prior credit. The DBFI PPO Preventive plan offers a benefit for preventive, basic and major services, therefore members who enroll in the DBFI PPO Preventive plan will earn coverage credit.

Diagnostic imaging

To find out if your doctor has gotten prior plan approval from Blue Cross NC before the scan is done, call Blue Cross NC Customer Service at the toll-free number on your ID card.

Blue Cross NC is working with a company called American Imaging Management (AIM) for the approval of high-tech scans. AIM has a website that lets doctors request approval for high-tech scans 24 hours per day, seven days a week. If your doctor does not have access to the Internet and the request is urgent, your doctor has two business days to file the paperwork to AIM in order for Blue Cross NC to approve the scan. If your doctor does not file the paperwork within two business days after an urgent request, Blue Cross NC may not pay for the scan.

If your doctor is in the Blue Cross NC network, he or she is responsible for getting prior plan approval from Blue Cross NC on your behalf. If your doctor is out-of-network or located outside of North Carolina, you are responsible for the cost of the scan if the doctor does not obtain prior plan approval before the scan is done.

Note: You do not need prior plan approval for a high-tech scan if it is part of an emergency room visit or an inpatient hospital stay.

Any outpatient scans (scans not done in an emergency room or as part of an inpatient hospital stay) on or after February 15, 2007, need prior plan approval from Blue Cross NC.

No. Prior plan approval is not required for "low-tech" scans such as X-rays, mammograms or ultrasounds.

If you have a scan in the emergency room or as part of an inpatient hospital stay, your doctor does not need to get approval from Blue Cross NC for the scan.

Enrollment

Answers vary according to your plan. To learn more, please visit the Help section and FAQs on your plan's member page.

No. Employers can shop for group ancillary plans* any time during the year and set their own enrollment periods for their employees. They can also add extra benefits (like life insurance) at any time.

*Group plans are plans that are offered through an employer.

If you have an individual or family health insurance plan: You can cover a newborn from their date of birth if the parent already has a health insurance plan in effect at the time of birth. The parent has 60 days to contact Customer Service to add the newborn to their existing plan.

If you have a health insurance plan through your employer: You must notify your employer or group administrator to add a newborn to your coverage. Some employer groups opt for a 60-day notice.

Please check your Benefit Booklet to find out how much notice is required by your plan.

If you are adding or removing a family member to or from your health coverage, you should notify your group administrator and complete any required forms within 30 days of the event.

Note: When adding a dependent to your coverage, the proper form must be completed within 30 days after the dependent becomes eligible for coverage in order to be effective on the date the dependent becomes eligible.

If you are adding an adopted child to your coverage, you must notify your employer or group administrator, provide documentation of the adoption, as needed, and complete the proper form. For the adopted child to be covered from the date of placement in the home, please complete the proper form as soon as possible. If you need to change your coverage type (for instance from an Individual to a Family plan), you must notify Blue Cross NC within 60 days. (NOTE: Some employer groups have opted for a 60-day notice. Please review your Member Guide to find out which guideline applies to you.)

You or your spouse's dependent children are eligible for coverage until their 26th birthday. Please review your Member Guide or consult your employer regarding dependent eligibility requirements.

You or your spouse's dependent children are eligible for coverage until their 26th birthday. Please review your Member Guide or consult your employer regarding dependent eligibility requirements.

A dependent child who is either mentally retarded or physically handicapped and incapable of self-support may continue to be covered under the health benefit plan regardless of age if the condition exists and coverage is in effect when the child reaches the age of 19. The handicap must be medically certified by the child's doctor and may be verified annually by Blue Cross NC.

We will mail you a new ID card. You should receive it within 7-10 business days. In the meantime, you can see your digital ID card on the member portal.

Just follow these steps: Log in to Blue Connect and select ID Card to see your digital card. You can also print a temporary ID card or select View Full Card to download it to your smart phone or laptop.

Note: If your policy has been canceled, you won't be able to order a new ID card.

Many groups only offer one health benefit plan. Groups offering more than one health benefit plan may have an annual or open enrollment period in which to change to a different benefit plan. Please contact your group administrator for more information.

An open enrollment period is a period of at least 10 days during which your employer will allow you to enroll or to make changes/adjustments to your coverage. Open enrollment periods are held once a year for those employer groups that offer open enrollment. Review your Member Guide or contact your group administrator for additional information regarding plan changes.

Everyone under the age of 65 has the opportunity to purchase health insurance during the Open Enrollment Period.

Open Enrollment is from November 1 to December 15 every year for coverage starting on January 1.

You can purchase a plan outside of Open Enrollment if you have a qualifying life event. There are many things that can be considered a qualifying life event, like: loss of health coverage (losing a job, turning 26, or graduating and losing a student plan), turning 65 and needing to purchase a Medicare plan, changes to your household (having a baby, getting married or divorced, death in the family), changes to your physical location (moving to a new county or ZIP Code, moving from a shelter into a home), becoming a U.S. Citizen, leaving jail or prison, and/or changes to your income that may affect a subsidy you qualify for.

Find care

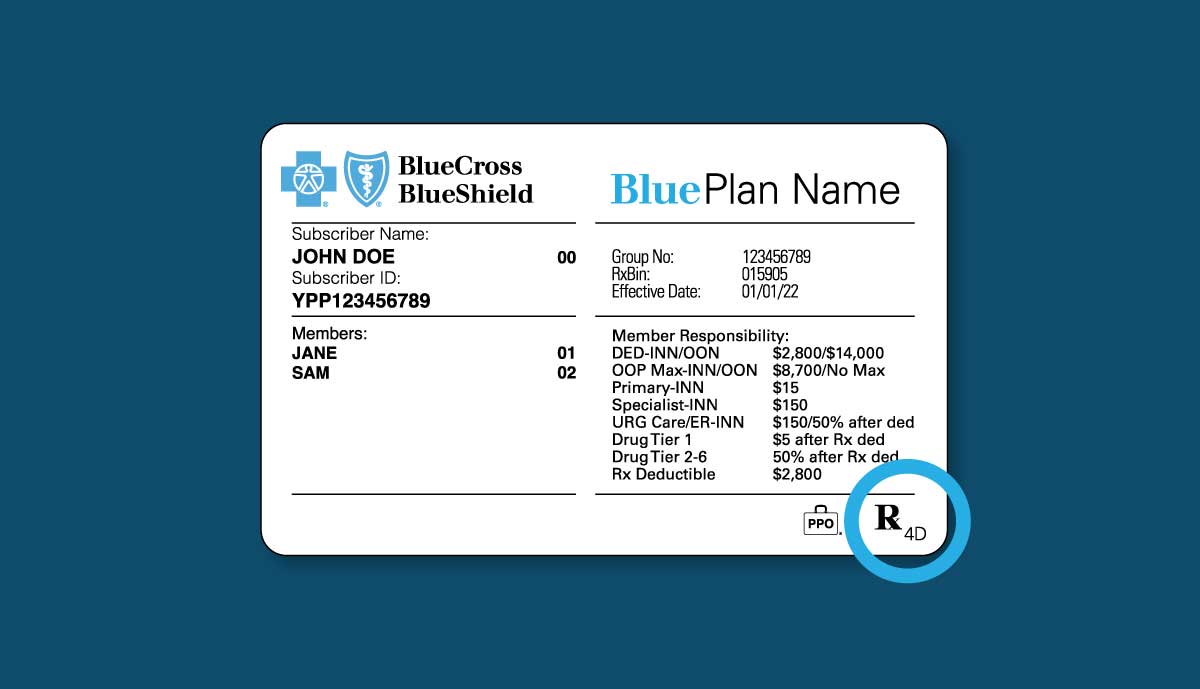

You can find your Rx letter code in the lower right corner of your member ID card (shown in the blue circle below). If you don't have a letter on your member ID card, please log in to Blue Connect℠ to find the name of your individual or employer drug plan.

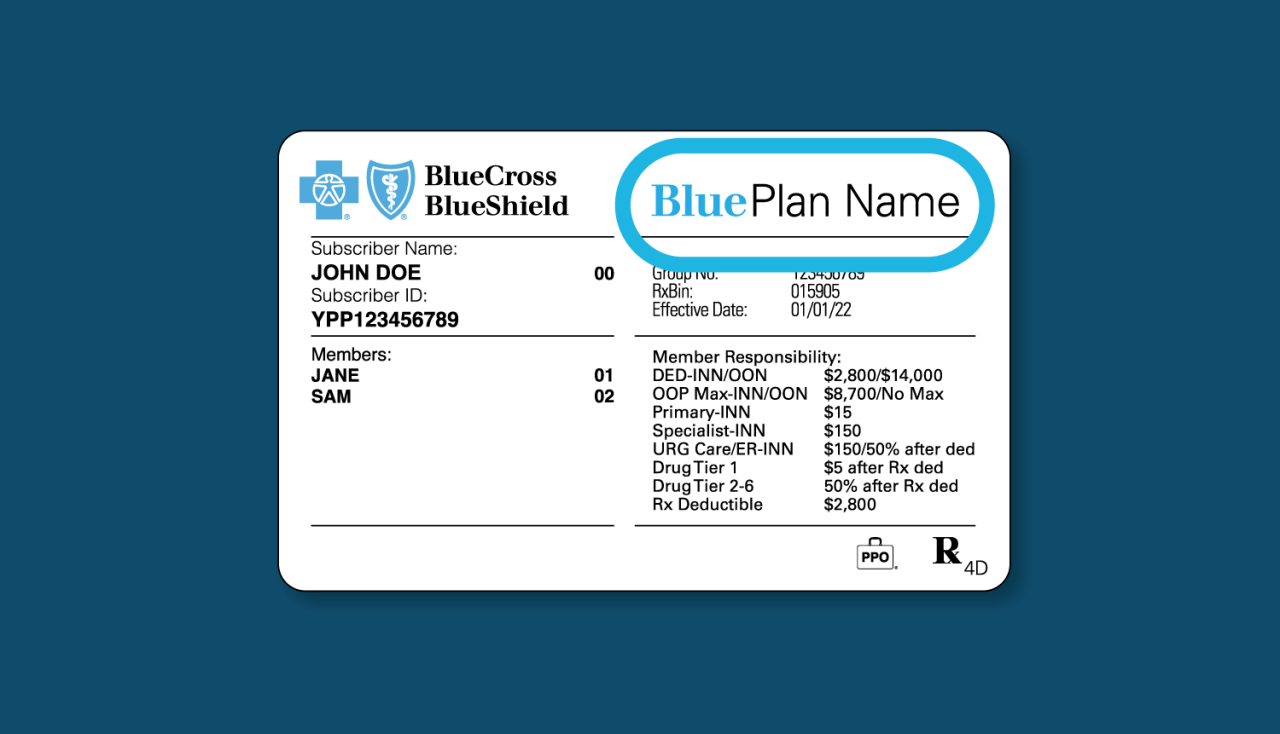

If you have a Blue Cross and Blue Shield of North Carolina (Blue Cross NC) plan, you'll find the name of your plan at the top of your member ID card.

You'll find the name of your Medicare plan at the top right of your member ID card or the bottom left. You can also find more plan details in the center of your card, below your Subscriber ID.

Prescriptions

Reimbursement varies according to plans. For more information, please refer to your Member Guide to find out if benefits are available for pharmacies outside of your network.

Our prescription drug mail service is provided by PrimeMail. You can order your prescriptions online or through the mail – choose whatever works best for you. For new prescriptions, you'll receive your medication 5-10 business days after PrimeMail receives your order. For refills, you'll receive your medication 3-5 business days after PrimeMail receives your order.

Members, learn more about PrimeMail.

Non-members, learn more about ordering prescription drugs.

If you will be going out of town for an extended time, benefits are available for an extended supply of up to 90 days for prescription drugs. However, you cannot refill a prescription until three-fourths of your current supply has been used. If you have not used three-fourths of your current supply but do not have enough medication to last through your trip, speak with your pharmacist about an early refill for up to an additional 30-day supply. If this amount is not enough, call Blue Cross NC Customer Service at 877-258-3334 for assistance.

Note: In some cases, employer groups carve out the prescription drug benefit and contract with a vendor separately, please refer to your Member Guide to confirm that your pharmacy benefits are offered through Blue Cross NC.

Blue Cross NC's prescription drug formulary is a list of FDA-approved prescription drugs reviewed and maintained by the Blue Cross NC Pharmacy and Therapeutics (P&T) Committee, comprised of independent physicians and pharmacists. Blue Cross NC offers an open formulary; therefore, no drugs are considered non-formulary.

If your prescription drug benefit is based on copayments, the formulary can help you determine your copayment for a specific drug. It also provides a list of possible therapeutic alternatives that may be available at a lower copayment.

If your prescription drug benefit is based on coinsurance, the formulary can help you identify any available low-cost, generic drugs.

If you would like an updated copy of the formulary, free of charge, please call Blue Cross NC's Customer Service at 877-258-3334. You should bring your copy of the formulary with you when you visit the doctor. You may also get formulary information by using the online Prescription Drug Search.

Note: In some cases, employer groups carve out the prescription drug benefit and contract with a vendor separately. Please refer to your Member Guide to confirm that your pharmacy benefits are offered through Blue Cross NC.

A generic drug is identical, or bioequivalent, to a brand name drug in dosage form, safety, strength, route of administration, quality, performance characteristics and intended use. Certain inactive ingredients that give the generic product its shape, color or flavor may be different than the brand product. Health professionals and consumers can be assured that FDA approved generic drugs have met the same rigid standards as the innovator drug. Although generic drugs are chemically identical to their branded counterparts, they are typically sold at substantial discounts from the branded price.

Depending upon your benefit design, you may substantially lower your out-of-pocket expense by using a generic drug instead of the branded drug. For example, if you have a $10 generic copay (tier 1) and $35 non-preferred brand copay (tier 3), you can save $25 on every prescription just by choosing generics. For drugs you take each month, that's a savings of $300 over an entire year. If your prescription drug benefit is based on coinsurance, generic drugs will save you money because they cost less than their branded counterparts. (In some cases, employer groups carve out the prescription drug benefit and contract with a vendor separately, please refer to your Member Guide to confirm that your pharmacy benefits are offered through Blue Cross NC.)

Preventive care

Sometimes you go to the doctor for preventive care and end up with a charge on your bill. You can avoid surprising costs by following these steps:

- When you schedule an appointment, ask for preventive care screenings and tests that are 100% covered by your plan.

- Ask if any tests or treatments done during your appointment are not considered preventive care.

- Ask if talking about other health problems that are not considered preventive care during your appointment will lead to extra costs.

- Ask if lab work can be sent to a Blue Cross NC in-network lab.

Preventive services are services you get when you are symptom-free and have no reason to think you are sick. These services may include immunizations, routine cholesterol checks, pap tests and blood pressure screenings. They are covered at no extra cost.

Diagnostic services, on the other hand, are services you get when you have symptoms of an illness or risk factors that might indicate a health problem. These services may include chest X-rays, thyroid tests, EKGs, urine tests and iron level testing. You may be responsible for some out-of-pocket costs.

Vision

You can only change your plan under certain circumstances. During the year, you can only change your vision plan if you have a qualifying life event like a marriage, divorce or birth. But you can change to a new plan at renewal.

Yes. You can use your insurance information at many online eye care centers. You can shop at:

- LensCrafters

- Target Optical

- Glasses.com

- ContactsDirect

- Ray-Ban

You can see a full list of network providers once you become a Blue Connect member.

Vision insurance plans are only for diagnosing and treating vision-related problems. If you visit your eye doctor for a medical issue, like pink eye, dry eye or eye surgery, you would use your regular health insurance as these are considered medical services.

We have an easy-to-use Find Care tool that lets you search for an in-network eye doctor. You can choose an eye doctor nearest you or who offers the services you want. You can also check to see if your current eye doctor is in our provider network.

Your provider's office will submit claims for you when you visit an in-network eye doctor. But if you go to an out-of-network eye doctor, you'll be responsible for filing your own claims and may have to pay a higher fee for services.

Choose an in-network eye doctor from our Find Care tool. Schedule your visit for a routine eye exam. Go in for your appointment and show your member ID card.

You should visit the eye doctor each year – especially if you have vision loss or need corrective lenses. It can be hard to notice subtle changes to your vision, so it’s important to visit your doctor each year. If you have an eye disease or progressive vision issue, your doctor may require you to have more frequent visits.

Get in touch with us

Our North Carolina customer service team is here to help.

Blue Cross and Blue Shield of North Carolina does not discriminate on the basis of race, color, national origin, sex, age or disability in its health programs and activities. Learn more about our non-discrimination policy and no-cost services available to you.

Information in other languages: Español 中文 Tiếng Việt 한국어 Français العَرَبِيَّة Hmoob ру́сский Tagalog ગુજરાતી ភាសាខ្មែរ Deutsch हिन्दी ລາວ 日本語

© 2023 Blue Cross and Blue Shield of North Carolina. ®, SM Marks of the Blue Cross and Blue Shield Association, an association of independent Blue Cross and Blue Shield Plans. Blue Cross NC is an abbreviation for Blue Cross and Blue Shield of North Carolina. Blue Cross and Blue Shield of North Carolina is an independent licensee of the Blue Cross and Blue Shield Association.